The Bank’s rate-setting monetary policy committee (MPC) will announce its latest decision at midday. It has already cut base rate five times since last August, most recently a month ago when it nudged rates from 4.25% to 4%.

Even that was a cliff-edge call, with four of the nine members voting to hold. Today’s decision won’t be nearly so close. Economists expect the MPC to sit tight, not just today but at its final two meetings this year in November and December.

Markets now put the chances of another cut in 2025 at just one in three. That’s grim news for households, mortgage borrowers and businesses struggling with the cost of debt.

Instead of light at the end of the tunnel, the gloom will drag on.

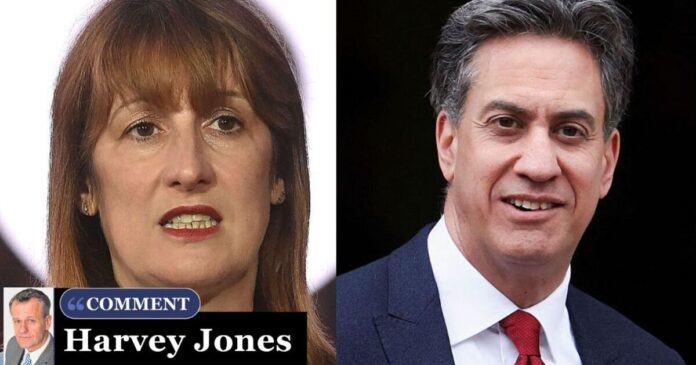

And we can thank Chancellor Rachel Reeves and Energy Secretary Ed Miliband for that. Their reckless policies have kept inflation high and made further cuts impossible for the rest of the year.

Yesterday the US Federal Reserve cut its benchmark rate to 4.25%. It can do that, with US inflation down to 2.9%.

More importantly, the Fed also signalled two further cuts this year, which could bring their rates down to 3.75%.

The European Central Bank has trimmed its main refinancing rate to 2.15%, with eurozone inflation steady at 2%. Other central bankers have room to act. Ours do not. Thanks to Reeves and Miliband.

The UK picture is far uglier. Inflation was stuck at 3.8% in August and the Bank of England expects it to rise to 4% in September.

Worse, it’s essentials that are driving the problem. Food price inflation is still running at 5.1% year-on-year, while energy bills are set to climb by another £100 in April to an average of £1,820, according to Cornwall Insight. That’s despite wholesale gas prices falling.

What on earth going on? Tom Clougherty of the Institute of Economic Affairs is clear: “Rising prices are in large part being driven by government policy in the form of higher taxes and regulatory costs.”

In short, we’re paying the price for ministers’ policy mistakes.

Reeves has done a heap of things to fuel inflation. She handed public sector workers inflation-busting pay rises, hiked employers’ national insurance to 15%, and cut the threshold to just £5,000.

At the same time she drove up the minimum wage by 6.7%. Food retail, hospitality and other low-wage sectors have simply passed these costs on, leaving consumers facing higher prices in supermarkets, shops, pubs and restaurants.

Households are also picking up the tab for Miliband’s green energy crusade.

By forcing fossil fuels out faster than the system can bear, he’s loading the costs of new grid infrastructure and renewable subsidies onto bills.

Cash-strapped Pensioners are hit hardest, since they spend a bigger slice of their income on food and heating.

Instead of easing the pressure, Reeves and Miliband are piling more on, leaving Britain with inflation stuck far above the US and Europe.

Reeves desperately needs lower interest rates to cut UK borrowing costs and create some fiscal headroom. She won’t get them. And as I’ve just shown, she doesn’t deserve to either. Sadly, it’s the rest of us who’ll pay the price.